Cash Management and Connectivity Made Easy

Empowering CFO and Treasurers’ decision-making can transform liquidity and the deployment of cash resources into key assets in the enterprise’s financial armoury. See, move, protect and optimise cash and other financial assets with informed confidence.

REQUEST A DEMO

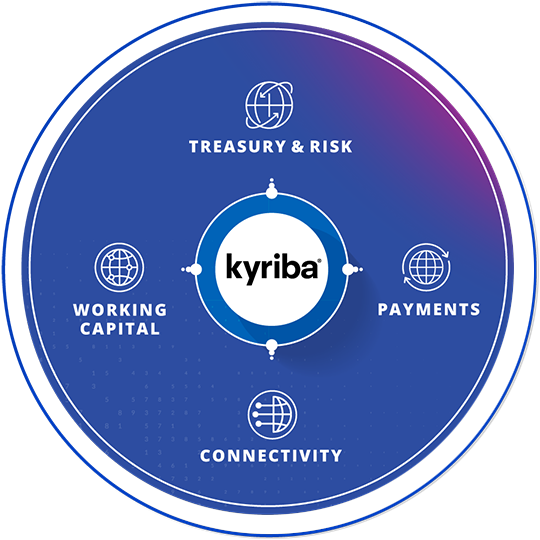

Enterprise Liquidity Management Platform

The Kyriba Enterprise Liquidity Management Platform connects systems, applications and data that strengthens an organization’s capability to improve financial performance. This unifies best-in-class treasury, risk management, payments and working capital solutions with external partners, including global banks, market data providers, trading platforms and third-party applications.

Learn why the world’s leading businesses choose Kyriba to manage their mission-critical capabilities for cash and risk management, payments and working capital optimisation.

- Protect against loss from risk and fraud

- Reduce costs through automation of keys tasks

- Enforce regulatory compliance on a global scale

- Drive growth opportunities through improved decision support

Submit the form to discuss your needs and questions with one of our experts.

Fill out the form and we will be in touch with you shortly.

The Value of Activating Enterprise Liquidity

After years of global economic expansion, many experts are forecasting uncertain times ahead. With Kyriba, treasury and finance leaders are in an advantageous position. They can see everything when it comes to their global cash, liquidity and risk exposures; and they can execute their strategies more easily and efficiently.

100%

Visibility into global cash and liquidity

80%

Increase in global productivity via cloud automation

$0.01

Reduce impact of currency volatility on EPS

50%

Average reduction in idle cash

70%

Increase in ability to work with other teams on strategic initiatives

Powered by the Kyriba Enterprise Liquidity Management Platform

Global SaaS Operations

A robust, secure and encrypted multi-tenant SaaS solution reduces time and costs and increase agility and speed to market compared with on-premise applications.

Connectivity

APIs and connectivity services bind the platform entities, both within the corporation and with external business partners, enabling highly efficient straight-through processing.

Liquidity Data Hub

Centralizing ERP and Bank connectivity builds an enterprise wide, cash centric view. Visibility into cash, risk and liquidity has never been easier.

Security

Kyriba provides comprehensive data security, protecting users from fraud and cybercrime, with the assurance of SOC1 and SOC2 Type II audit certification.

From Our Clients

"The main benefit I personally get from Kyriba is risk mitigation through much greater confidence in my treasury. I receive meaningful data to analyse, including automated standardised reports and accurate cash forecasts."

ANDREW NICHOLSON

CFO, GRAFF DIAMONDS

"Our goal was to create a solution oriented and agile treasury. We needed a secure, robust and scalable solution that integrated well with our systems, and we found that Kyriba was best aligned to support our needs."

VP Corporate Finance & Treasury,

Spotify

"I have worked with Kyriba about ten years now, and I’ve watched it grow and respond to its customers – truly valuing our feedback in a way that I’ve never seen another provider do."

TRISH FISHER

DIRECTOR, TREASURY OPERATIONS, WEWORK